Last Updated On: 18 Feb 2026

5 min read

Macroeconomic Update

Equity Market Update

Debt Market Update

Macroeconomic Update

Growth in US continues to hold up well as suggested by strong readings in both manufacturing and services PMI. Labour markets in US, though weak, seem to have stabilised. Wage growth continues to be strong, and this is reflected in strong retail sales. Growth in EU too continues to hold up well as reflected by strengthening services activity and a gradual rebound in manufacturing. On the other hand, growth in China continues to be weak as domestic consumption demand continues to be dragged down by weak property markets.

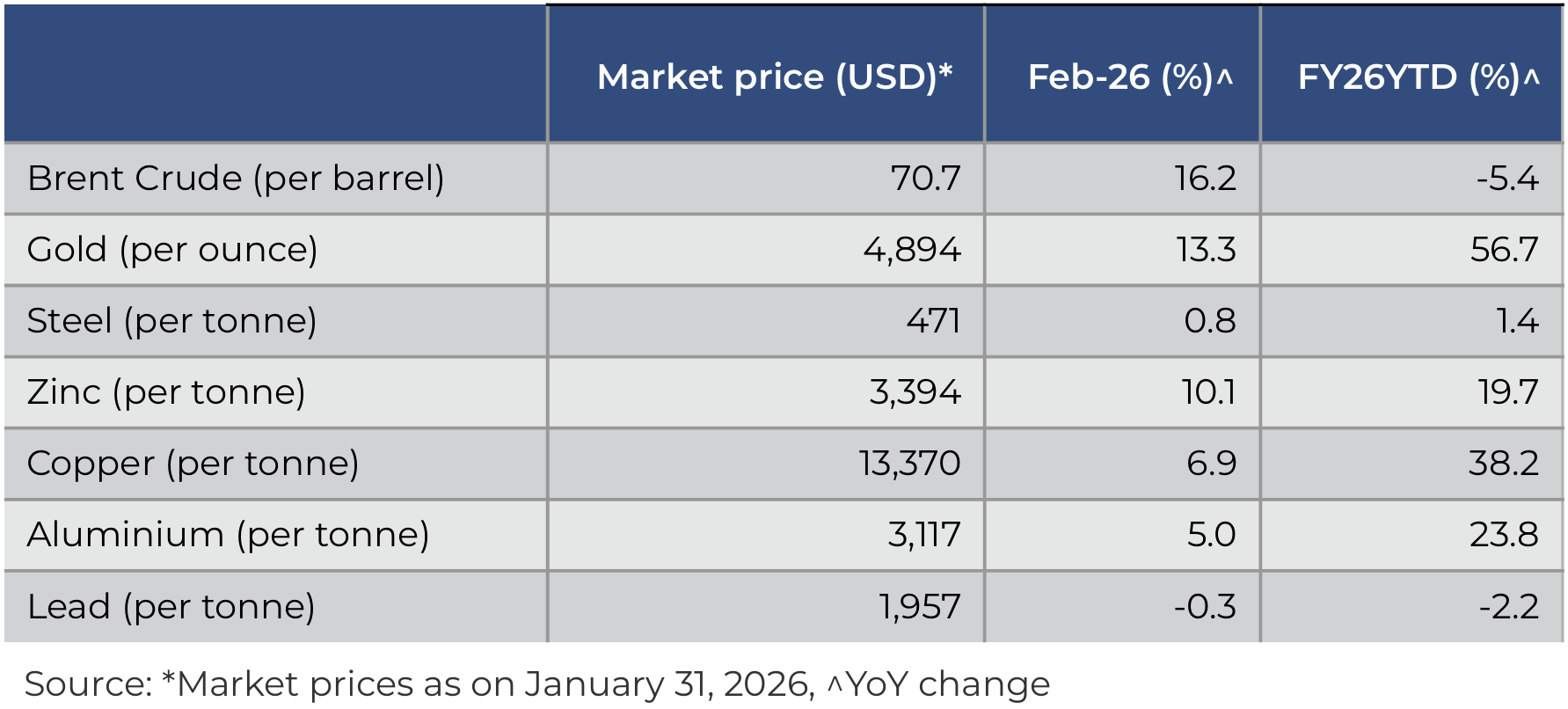

Inflation in US and EU remained contained and in line with expectations. On the other hand, China's consumer prices rose to 34 month high, but producer prices remained in deflationary zone. Fed kept the policy rates unchanged in its latest meeting and is expected to keep status quo on rates in the coming months. ECB too is expected be on a pause on rates throughout 2026.

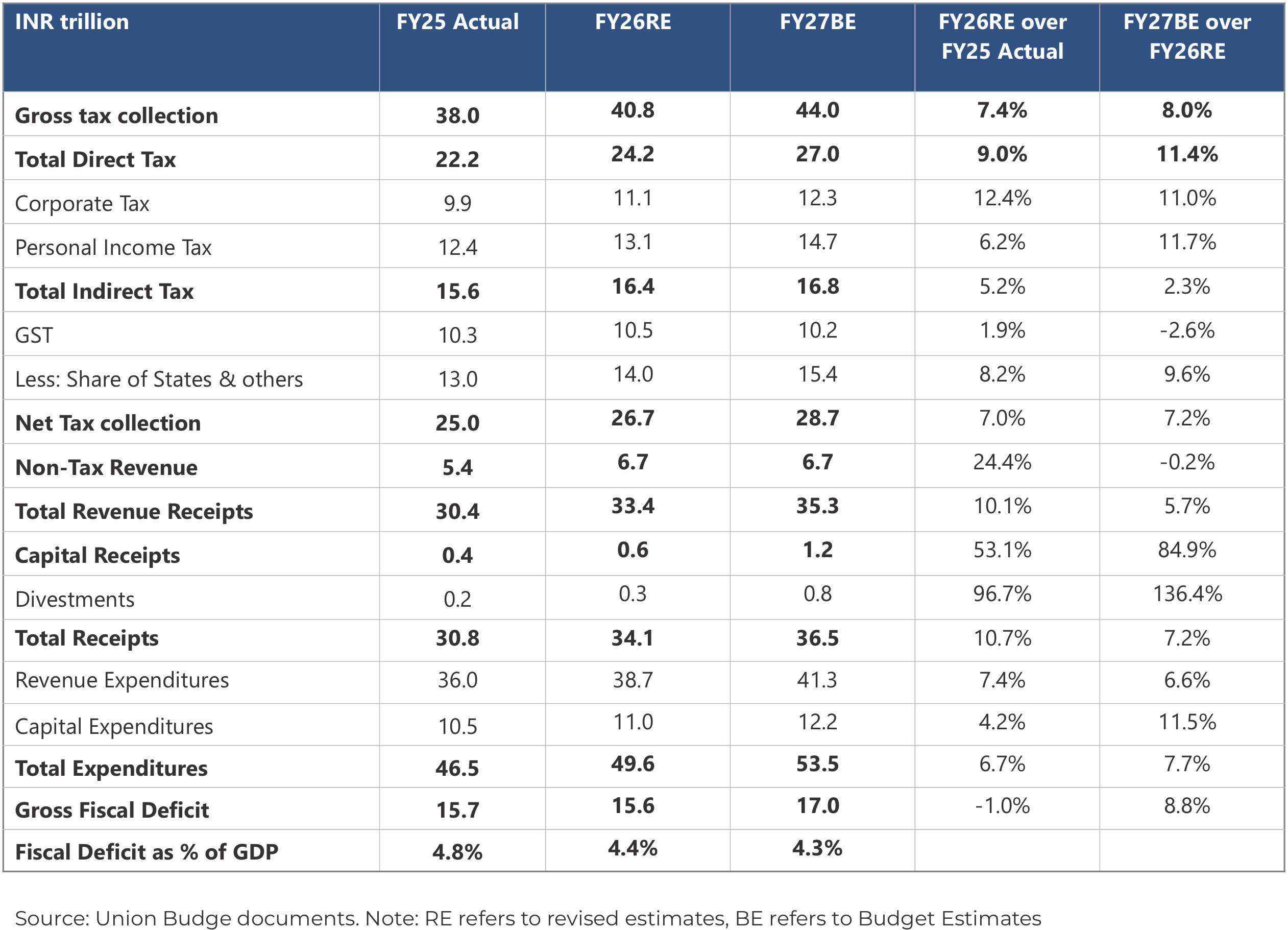

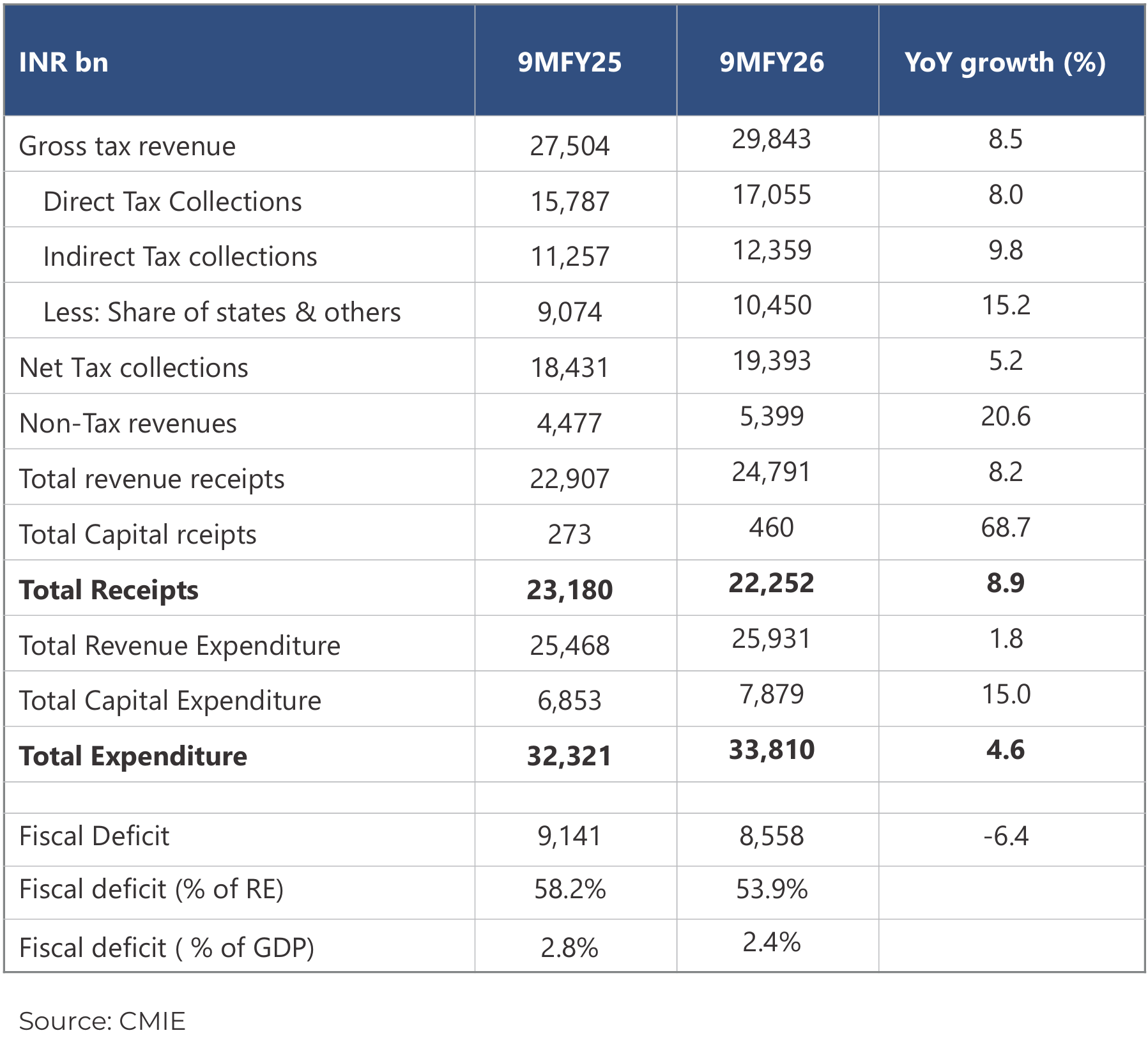

Government stuck to fiscal consolidation path: The Government stuck to fiscal deficit target for FY26 despite large shortfall in tax revenue through a mix of reduced expenditure and higher non-tax revenue. For FY27, the Government adhered to fiscal consolidation path by targeting fiscal deficit of 4.3% of GDP (vs 4.4% of GDP in FY26) and reiterated its commitment to bring down Central Government debt to GDP to 50% (+/-1%) by FY31. Government has assumed tax revenue growth of 8% YoY in FY27 - compared to a nominal GDP growth assumption of 10% - which appears realistic. However, gross borrowing target of Rs. 17.2 trillion was higher than market expectations.

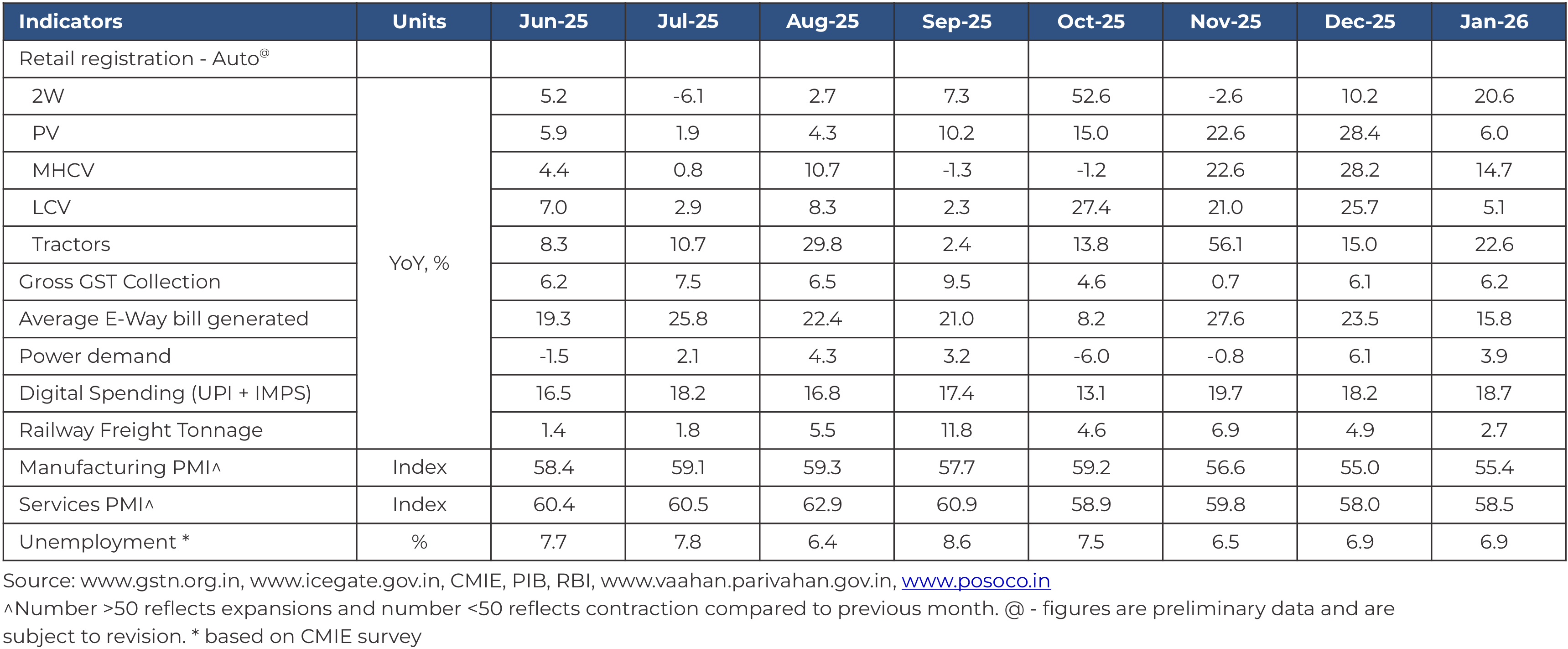

Indian economic activity remained upbeat in Jan: The high frequency indicators for January suggest that growth continues to hold up well. The effect of tax cuts on demand is clearly visible especially on vehicle registrations which continue to post strong growth for fourth month in a row (GST cuts became effective on 22nd September 2025). Power demand too continues to hold up and GST collections seems to have stabilised.

Going forward, demand is likely to remain healthy on the back of tax cuts, lagged effect of monetary easing and key trade deals especially that with US and EU. Also, prospects of a good rabi harvest and low inflation are likely to keep rural demand buoyant.

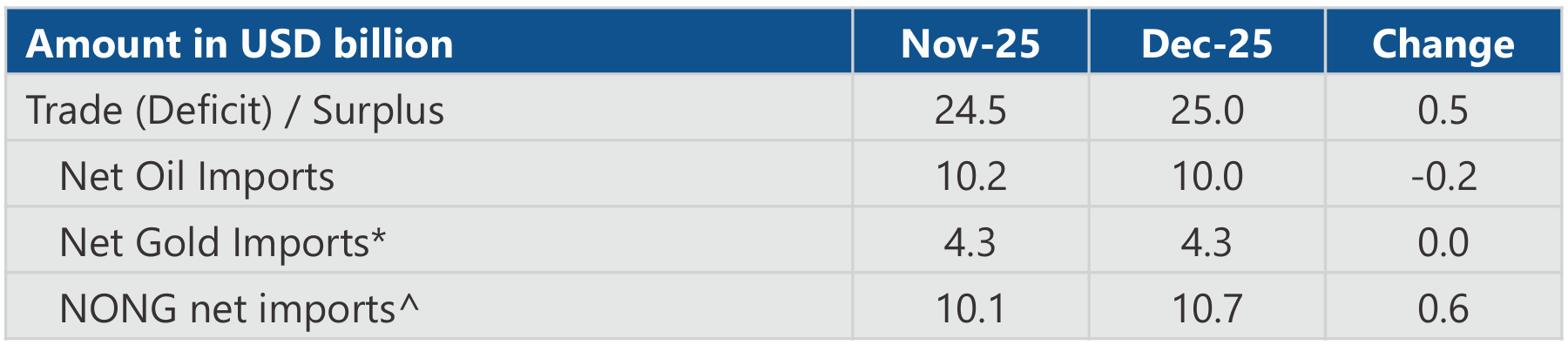

Tax revenue growth picks up in December: Tax revenue growth picked up significantly in December led by GST collections. GST collections were higher due to higher-than-expected jump in IGST collections most probably due to withholding of refunds to states. On the spending side, the Government has shown restraint. While capex growth has started moderating post front loading in the first half of the fiscal, revenue expenditure is up just 1.8% YoY in 9MFY26.

According to revised estimates for FY26, the Government has indicated that it will adhere to the fiscal deficit target of 4.4% of GDP despite shortfall in tax revenue. This will be achieved through a combination of expenditure cut (largely revenue expenditure) and higher non-tax revenue.

Summary and Conclusion

Global growth continues to hold up well led by the US. However, uncertainty remains high amidst geopolitical realignments and risk of flare ups. India and US reached an agreement on the trade deal where US will lower tariff from 50% to 18% though details on the same are awaited. The US President's announcement that Kevin Warsh will replace Jerome Powell as Fed chair adds another layer of uncertainty regarding Fed's policy going forward. Growth in China is following a two-speed path where domestic consumption and property markets are in a slow lane, but exports and manufacturing are holding up well.

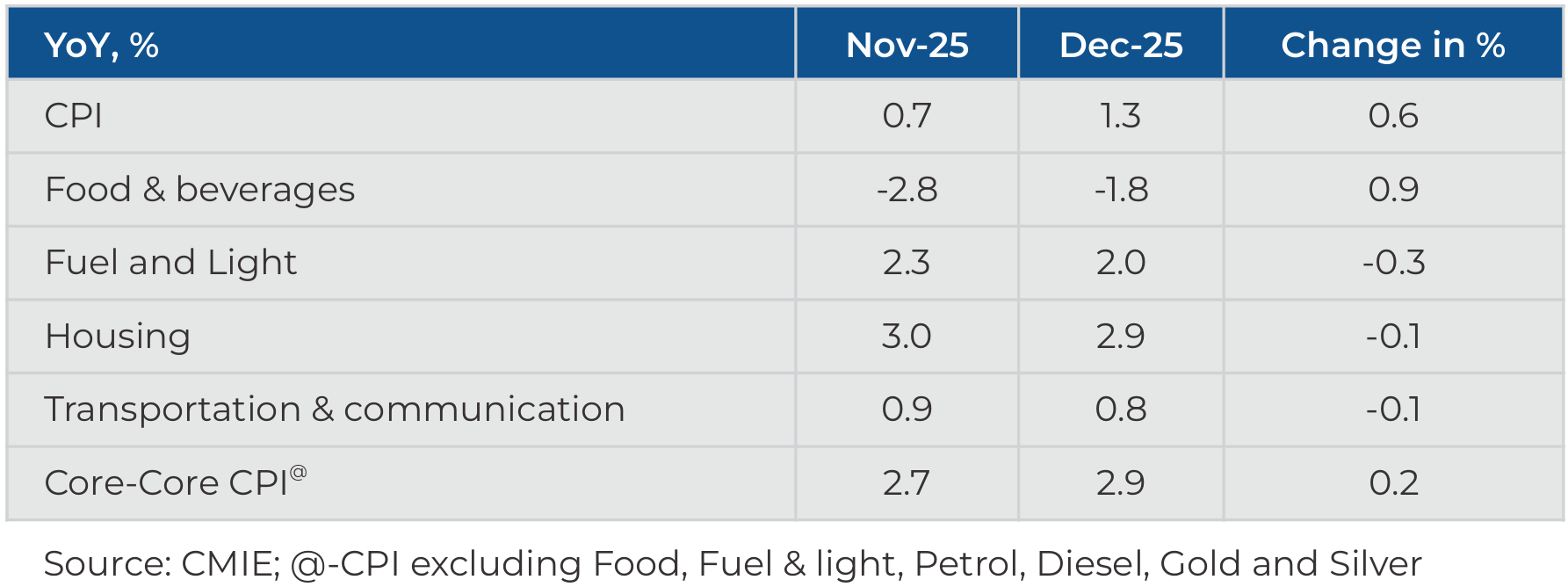

Growth in India has held up well on the back of fiscal (income tax and GST cuts) and monetary (lowering of interest rates) stimulus. High frequency indicators have steadily improved over the last few months with rural demand continuing to hold up well and urban demand too showing signs of uptick. Inflation remains well anchored and though it's expected to rise from here on due to base effect, it's likely to remain close to RBI's target of 4%.

Looking ahead, India's growth is likely to be steady as Government continues take up reform measures. Monetary easing too will continue to boost demand this year as monetary policy works with a lag. Several trade deals, especially those with the EU and US, will also support growth going forward. Overall, medium-term outlook for the Indian economy seems optimistic, in our view.

Did you find this interesting?

Your opinion matters - share your thoughts and help us improve.