Register Now

Zindagi Ke Liye SIP

Just like life’s small, consistent efforts lead to big rewards, SIP turns steady investments into long-term growth

Zindagi Ke Liye SIP

Why choose SIP to start your investment journey?

Ease of starting

No need for large investment amounts—SIPs can begin with as little as ₹100/month. You can also select the frequency and tenure based on your convenience.

Automated & Disciplined

Payments are auto-debited from your Bank account making investing disciplined and completely hassle-free.

Potential For Higher Growth

As markets are bound to remain volatile, regular investing gives you freedom from market timing and benefit from volatility.

Demystifying Mutual Funds and SIPs

Let’s demystify the myths behind investing and SIPs

Mutual Funds are too risky, I could lose my money

I am not that tech savvy.

I don’t know which fund to invest in

I already invest in FDs and Gold, so I don’t need anything else

I am too young to invest.

I need a lot of money to invest in Mutual Funds

SEE MORE

How to Start Your SIP?

- Define your goalcomplete Define your goal

- Choose the right fundcomplete Choose the right fund

- Complete KYCcomplete Complete KYC

- Decide SIP Amount & frequencycomplete Decide SIP Amount & frequency

- Select investment platformcomplete Select investment platform

- Set up auto-debitcomplete Set up auto-debit

- Track and stay investedcomplete Track and stay invested

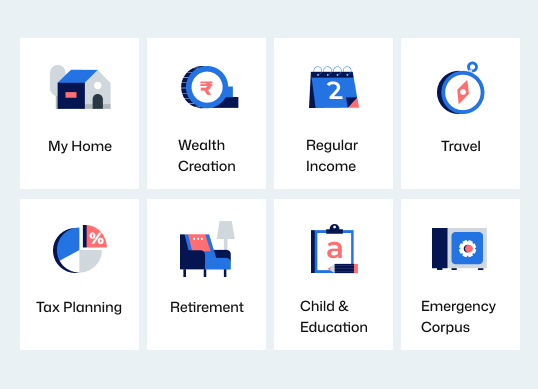

Decide your investment purpose - wealth creation, education, retirement, travel, etc.

Pick from Equity, Debt, or Hybrid funds based on your risk appetite and time horizon. As you are just beginning, take the help of an MFD/Advisor.

Submit PAN, Aadhaar, and bank details for easy verification.

It can be based on your goal or what you can start to get comfortable with the concept of SIP. You can increase as you grow confident.

Invest via your trusted MFD/Advisor or nearest Bank Branch or new-age apps.

Link your Bank Account for automatic SIP deductions.

Review your investments regularly and stay consistent for long-term growth!

See your SIP growth in action

Use the HDFC SIP Calculator to estimate your returns and plan your investments with confidence

Disclaimer : This tool has been designed for information purposes only. Actual results may vary depending on various factors involved in capital market. Investor should not consider above as a recommendation for any schemes of HDFC Mutual Fund. Past performance may or may not be sustained in future and is not a guarantee of any future returns.

- SIP Calculator

- SIP Goal Calculator

Investing frequency

- Daily

- Weekly

- Monthly

- Quarterly

Expected Rate of Return

SIP Duration

Total Investment

₹0

Total SIP Value

₹0

YOUR EARNING’S

₹ 0Watch how the SIP story unfolds

FAQs

Mutual Funds pool money from multiple investors and invest it across diverse assets like stocks, bonds, and other securities to achieve a common financial goal. These funds are professionally managed by experienced Fund Managers, who analyze market trends, carefully select investments, and actively manage risks to optimize returns.

Systematic Investment Plan (SIP) is probably a retail investor’s best friend, as it allows you to invest small amounts regularly—daily, weekly, or monthly—in Mutual Funds, ensuring discipline, convenience, and long-term growth.

Mutual Funds are investment vehicles that pool money from multiple investors to invest in various securities such as stocks, bonds, or a combination thereof, managed by professional Fund Managers. A Systematic Investment Plan (‘SIP’) is just one of the many methods of investing in a Mutual Fund scheme. In SIP a fixed amount (or as may be specified) is invested regularly into Mutual Funds, providing investors with disciplined and hassle free investing.

With SIP, because the amount invested in each instalment is fixed, you get more units when the NAV (Net Asset Value) of the Scheme, is low and you get less units when the NAV are high. This generally reduces the impact of market volatility in the long-term and is known as rupee cost averaging.

NAV stands for Net Asset Value. When you invest in any Mutual Fund Scheme, you are allotted units of that Scheme. NAV is net asset value of one unit in that Scheme. The NAV per unit is calculated by dividing the net assets of the scheme (Market/Fair Value of Investments + Current Assets - Current Liabilities and Provisions) by the number of units outstanding under that scheme.

Total number of units in the Mutual Fund scheme multiplied by the NAV is the AUM/Market Value of that Fund.

SIP top-up allows you to automatically increase your SIP amount (by Amount or specified %) at pre determined frequency. It aims to help your money to not only keep up with inflation but also grow in line with your increasing investing capacity over time without worrying about anything.

SWP is a feature offered by Mutual Funds that allows investors to regularly receive a predetermined amount of money at specified intervals as per the choice of the investors or the norms of the particular scheme, from their holdings in that Scheme. Unlike SIP (‘Systematic Investment Plan’), which involves regular investments, SWP involves periodic withdrawals and can take care of investor’s needs of regular cashflow.

It's an investment mode where you can regularly transfer a fixed amount of money from one Mutual Fund scheme to another Mutual Fund scheme within the same fund house. This strategy helps investors gradually move funds from a relatively safer asset class to a potentially higher return and risk asset class over time and vice versa, reducing the risk associated with timing the market.

There are many common mistakes that one must avoid to enjoy the full potential of SIPs. These include not having a goal or having an unrealistic goal, choosing the wrong scheme based on your risk profile and investment objective, not investing with discipline and stopping SIP when markets are volatile, not topping up your SIP, not reviewing your investments periodically and so on...

Compounding refers to benefit from earnings being reinvested to generate returns on original invested amount including returns generated over time, leading to potential exponential growth. Starting early, long-term investing and regular contributions are essential to fully benefit from the compounding effect.

An Investor Education And Awareness Initiative

Visit https://www.hdfcfund.com/information/key-know-how to know more about the process to complete a one-time Know Your Customer (KYC) requirement to invest in Mutual Funds. Investors should only deal with registered Mutual Funds, details of which can be verified on the SEBI website (www.sebi.gov.in/intermediaries.html). For any queries, complaints & grievance redressal, investors may reach out to the AMCs and / or Investor Relations Officers. Additionally, investors may also lodge complaints directly with the AMCs. If they are not satisfied with the resolutions given by AMCs, they may raise complaint through the SCORES portal on https://scores.sebi.gov.in/scores-home/. SCORES portal facilitates investors to lodge complaint online with SEBI and subsequently view its status. In case the investor is not satisfied with the resolution of the complaints raised directly with the AMCs or through the SCORES portal, they may file any complaint on the Smart ODR on https://smartodr.in/login.