Last Updated On: 13 Oct 2025

In an unexpected move, the Monetary Policy Committee (MPC) decided to lower the policy repo rate by 50bps to 5.5% and to change policy stance from ‘accommodative’ to ‘neutral’. Five out of six members voted in favour of 50bps cut in policy repo rate while one member voted for a 25bps cut. In another unexpected move, the RBI decided to reduce Cash Reserve Ratio (CRR) by 100bps in 4 tranches of 25bps each (with effect from the 4 weeks beginning September 6, October 4, November 1 and November 29, 2025). This is expected to release extra liquidity of ~₹2.5 trillion by December 2025.

The Committee noted that “After having reduced the policy repo rate by 100 bps in quick succession since February 2025, under the current circumstances, monetary policy is left with very limited space to support growth” suggesting RBI would like to pause and assess the impact of its steps and analyse incoming data before taking any further action.

The RBI has prioritised growth and has frontloaded its actions as it believes that inflation is not only ‘durably aligned’ but is likely to ‘undershoot the target at the margin’ and therefore it makes sense to support domestic consumption and investment at this juncture.

Conclusion and Outlook

The RBI’s decision to lower policy repo rate by 50bps was a surprise as the market was expecting RBI to lower the policy rate by 25bps. This coupled with the fact that RBI also decided to lower CRR by 100bps (in four tranches of 25bps each) suggests RBI decided to prioritise growth and front load its actions to remove any ambiguity. Its acknowledgement that after these actions ‘monetary policy is left very limited space to support growth’ and change in stance from accommodative to neutral suggests that RBI would like to wait and assess the impact of their actions on growth-inflation dynamics before taking further action. The yield curve steepened post policy with curve upto 5 years rallied by 5-8bps while beyond 6 year it sold off by 3-6bps.

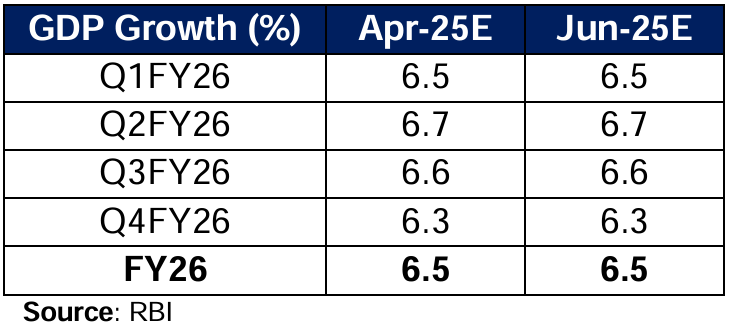

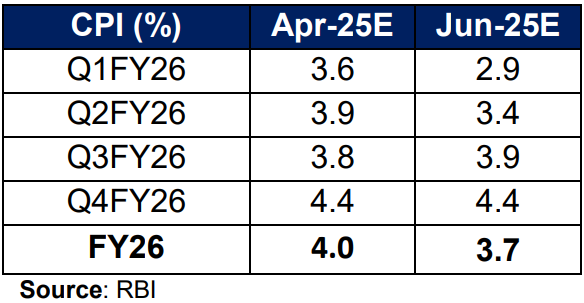

As highlighted by RBI, CPI inflation is likely to remain below RBI’s mid-point target of 4% in FY26. Going forward, the RBI is likely to take a wait and watch approach as the neutral stance provides RBI with flexibility to move in either direction.

In our view, medium term outlook on Indian fixed income market remains favourable, considering:

- Headline CPI inflation is likely to undershoot RBI target of 4% in FY26. Also, domestic growth and Core CPI momentum remains subdued.

- Liquidity is likely to be in ample surplus given RBI’s past actions and CRR cut today

- External sector could remain comfortable in view of steady growth in services exports, decline in oil prices and adequate foreign exchange reserves.

- Government sticking to path of fiscal consolidation and reiterating to bring down its debt to GDP bodes well for supply of G-Sec over the medium term

- Uncertainty around tariffs dampens growth sentiments

Key risk to the favourable outlook:

- Below normal monsoon posing risk to food prices

Overall, in our view, yields are likely to remain rangebound with a downward bias. Falling inflation and front loading of policy rate cuts is positive from yields perspective. Thus, in view of significant liquidity provision, and attractive corporate bonds spreads (over G-Sec), one may consider investment in medium duration (schemes with duration of upto 5 years) categories especially corporate bonds focussed funds in line with individual risk appetite. Further, as long bond spreads have widened over 10 year G-secs, investors with a relatively longer investment horizon could continue with their allocation to longer duration funds in line with individual risk appetite.

DISCLAIMER

The views of HDFC Asset Management Company Limited, Investment Manager for HDFC Mutual Fund expressed herein as of 6 th June 2025 are based on internal data, publicly available information and other sources believed to be reliable. The source for this document is the Bi-monthly Monetary Policy Statement, 2023-24, dated 6 th June 2025 published by the RBI. Any calculations made are approximations, meant as guidelines only, which you must confirm before relying on them. The information contained in this document is for general purposes only and is not investment advice. The document is given in summary form and does not purport to be complete. The document does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. The information/ data herein alone are not sufficient and should not be used for the development or implementation of an investment strategy. The statements contained herein are based on our current views and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Past performance may or may not be sustained in future. HDFC Mutual Fund/HDFC AMC is not guaranteeing/ offering/communicating any indicative yields or guaranteed returns on investments made in the scheme(s). Neither HDFC AMC and HDFC Mutual Fund (the Fund) nor any person connected with them, accept any liability arising from the use of this document. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice.

Did you find this interesting?

Your opinion matters - share your thoughts and help us improve.