Last Updated On: 4 Feb 2026

5 min read

What’s the Point?

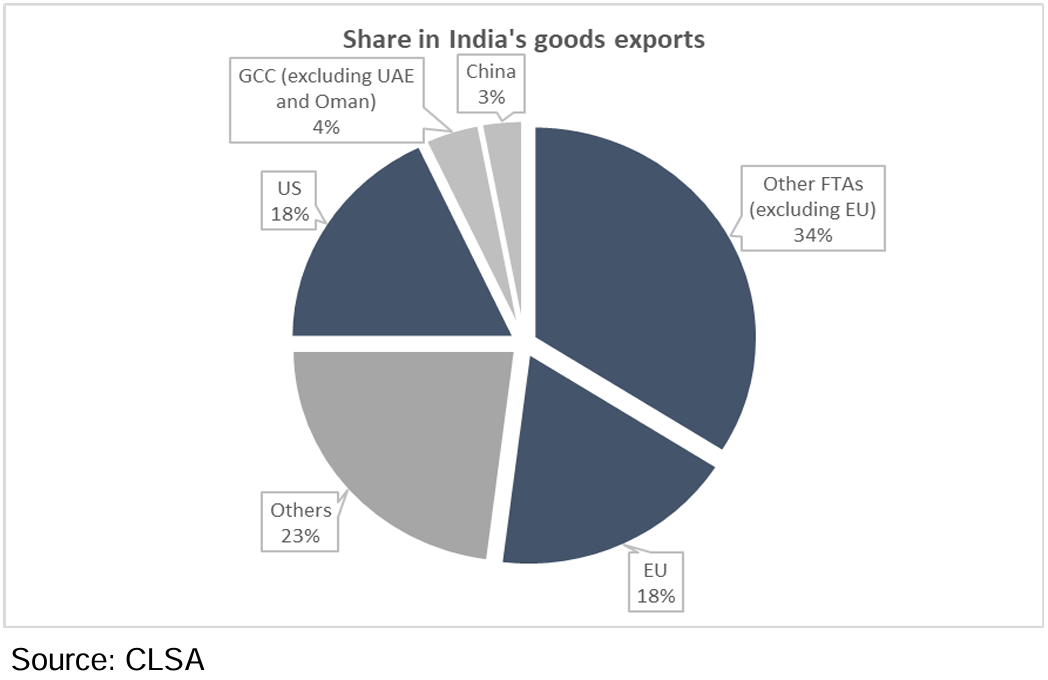

The US (~18%) and EU (~18%) together account for ~36% of India’s goods exports.

The recently signed FTA with EU and trade deal with US (details awaited) would go a long way in strengthening India’s macro and micro variables.

Key beneficiaries include labour intensive sectors, enhancing India’s competitiveness in the EU and US markets.

Both the deals strengthen India’s export engine, deepens integration into global value chains and supports manufacturing competitiveness.

US-India have reached a trade agreement wherein US would lower reciprocal tariffs on India’s exports from 25% to 18%. While the final details are awaited, another deal of significant magnitude that was signed was the India-EU Free Trade Agreement (FTA). These announcements add to India’s recent FTA momentum, with India signing as many as eight FTAs in the past five years, including four deals in the past one year; UAE and Australia (2022), EFTA, Oman, UK, and New Zealand (2025), and now the EU after a decade‑long lull prior to 2021.

Contours of the India–EU FTA

India has gained preferential access to the European markets across 97% of tariff lines, covering 99.5% of trade value:

- 70.4% tariff lines covering 90.7% of India’s exports will have immediate duty elimination for important labour intensive sectors

- 20.3% tariff lines covering 2.9% of India’s exports will have zero duty access over 3 and 5 years for certain marine products, processed food items, arms and ammunition, amongst others

- 6.1% tariff lines covering 6% of India’s exports will have preferential access by way of tariff reduction

On the other hand, India is offering 92.1% of its tariff lines which covers 97.5% of the EU exports at reduced tariffs.

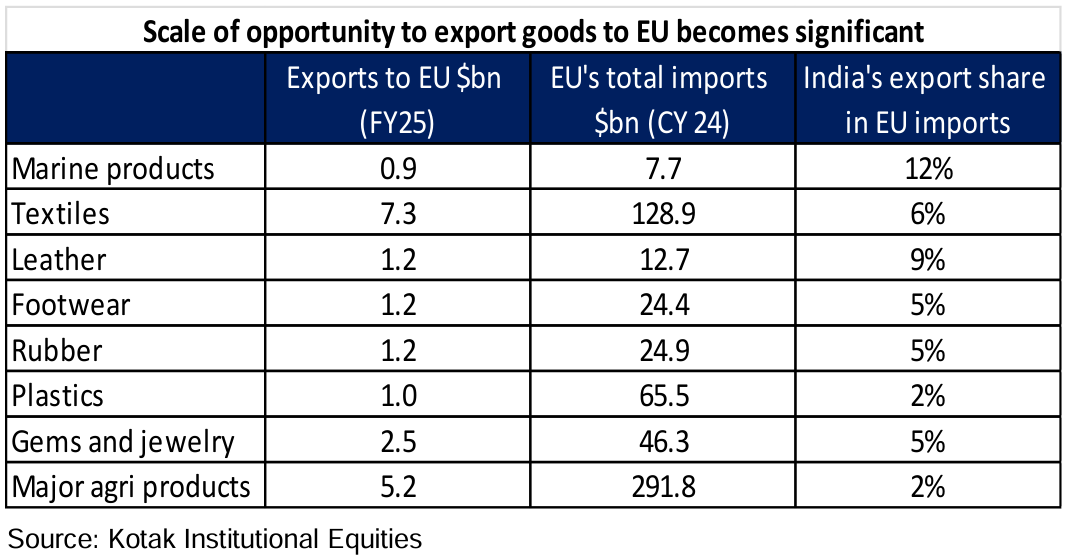

Sector Wise Impact – India – EU FTA

Agricultural Goods - The FTA is expected to have a significant positive impact on the Indian agricultural and processed food sector. Preferential Market Access for agricultural products like tea, coffee, spices, grapes, gherkins and cucumbers, dried onion, fresh vegetables and fruits as well as for processed food products will make them more competitive in the EU.

Reduced Tariffs on Imports - Reduced tariff rates on auto/auto parts, metals, plastics, machinery, beverages are likely to induce competition in the domestic market while aiding some importers through lower tariffs.

While tariffs on cars imported from EU to India will be reduced from 70-110% to as low as 10%, there will be limited impact on Indian auto manufacturers as most of the European vehicles (excluding certain high-priced models) are currently manufactured in India or assembled from complete knock down (CKD) kits that attract just 16.5% import duty.

US Tariff Overhang behind

US-India have reached a trade agreement wherein US would lower reciprocal tariffs on India’s exports from 25% to 18%. In addition, as India has agreed to stop importing Russian crude oil, the punitive tariff of 25% on India also goes away. Effectively, tariffs on Indian goods have been slashed from 50% to 18%. With this, the tariff rate on Indian goods is now more in line with tariffs imposed on other countries. Labour-intensive sectors such as textiles, gems/jewellery stand to benefit. While the deal has been announced, final details are awaited.

Conclusion

The US and EU together account for ~36% of India’s goods exports, making recent trade deals highly significant. The India–EU FTA is a landmark agreement, granting India preferential access across 97% of tariff lines, with immediate zero-duty access for most labour-intensive exports. This sharply boosts competitiveness in sectors like textiles, agriculture and processed foods. Parallelly, the US–India trade agreement reduces tariffs on Indian exports from an effective 50% to 18%, easing a major overhang. Together, these deals strengthen India’s export engine, deepen global value chain integration, support manufacturing competitiveness, and reinforce India’s strong momentum in forging high-impact trade agreements.

Sources: CLSA, Kotak Institutional Equities and other publicly available information

About Tuesday’s Talking Point (TTP): TTP is an effort by HDFC AMC to guide key conversations in the Indian financial markets and investing ecosystem. We aspire to do this by providing relevant facts, along with our perspective on the issue at hand. Please provide your feedback at this link: https://forms.office.com/r/Cr8JNjMGWk

Disclaimer: Views expressed herein are based on information available in publicly accessible media, involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied herein. The information herein is for general purposes only. Stocks/Sectors/Views referred are illustrative and should not be construed as an investment advice or a research report or a recommendation by HDFC Mutual Fund (“the Fund”) / HDFC Asset Management Company Limited (HDFC AMC) to buy or sell the stock or any other security. HDFC AMC is not indicating or guaranteeing returns on any investments. Past performance may or may not be sustained in the future and is not a guarantee of any future returns. The recipient(s), before taking any decision, should make their own investigation and seek appropriate professional advice.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

Did you find this interesting?

Your opinion matters - share your thoughts and help us improve.