Last Updated On: 11 Nov 2025

5 min read

What’s the Point?

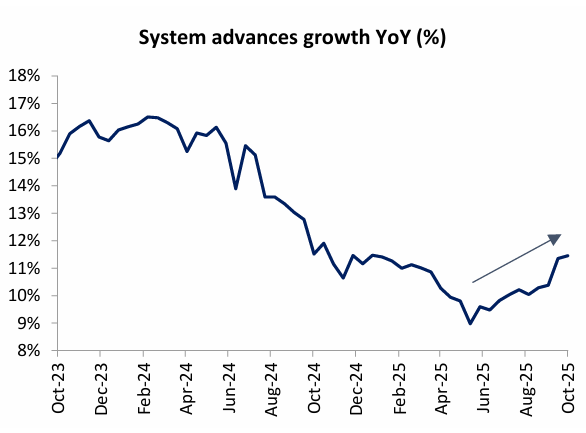

- After two years of muted lending, India’s credit growth is showing early signs of recovery; for the fortnight ending 17th Oct’ 2025, YoY credit growth was at 11.45%.

- Festive demand, government measures, improved liquidity, and stable asset quality have led to improved system credit demand.

- The RBI’s rate cuts and benign inflation outlook support the sector, though further cuts could compress margins slightly due to limited room to lower deposit rates.

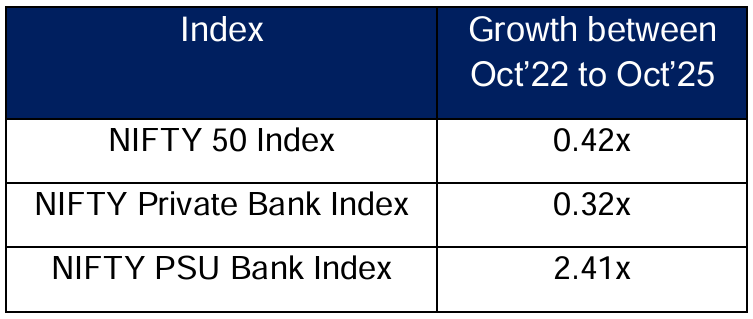

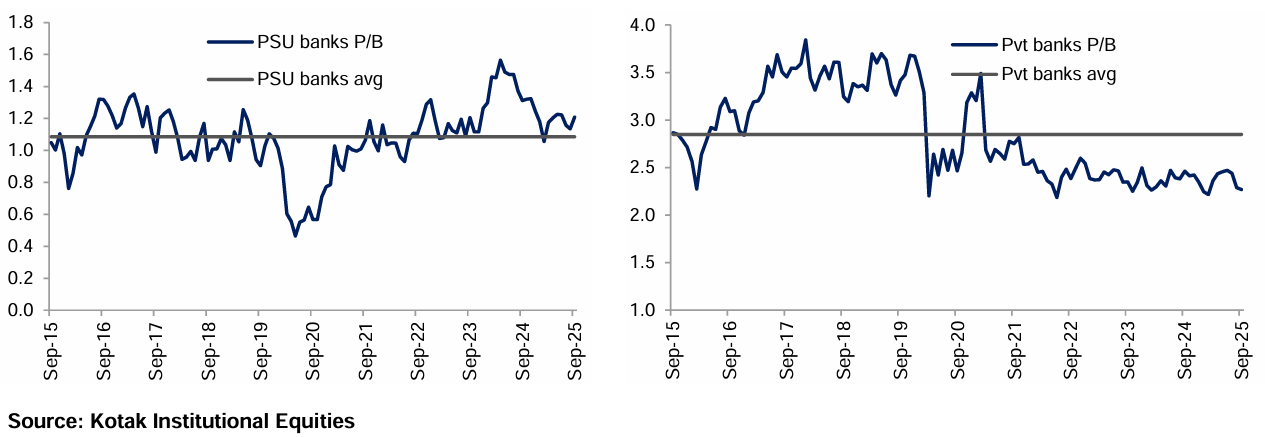

- PSU banks have significantly outperformed in the past 3 years, with the NIFTY PSU Bank Index rising 2.4x, while private banks have lagged during the same period. Private banks now trade below long-term average valuations, offering attractive entry points.

- With credit growth picking up and valuations being reasonable, one may consider investing in funds that have high exposure to private banks.

Uptick in Credit Growth

The upturn has been supported by a combination of factors. Early festive season, alongside government measures such as targeted tax rebates, GST rationalization, lower interest rates and improved liquidity in the system, are beginning to reflect in higher lending activity and improved system credit demand.

This inflection comes at a time when balance sheets across the banking sector continue to remain robust and asset quality trends continue to hold steady. The micro finance and unsecured loans segment which was impacted is also showing signs of stability and turnaround. Recent management commentaries also suggest that there has been sequential improvement in Non-Performing Assets (NPA) and Special Mention Account (SMA) positions.

Monetary Easing

Apart from credit off-take, another factor that is positive for the banking sector is fall in interest rates. The central bank has already cut interest rates in the current calendar year and the outlook for the next 6-12 months could also remain positive, given the low inflation environment.

While fall in yields may have a positive mark to market impact on the banks bond portfolio, incremental rate cuts could have some negative earnings impact for banks, as their ability to cut deposit rates (savings and term) may be less than in the past, which could have impact on the Net Interest Margins. This can lead to a slight cut in profit estimates for banks for FY27.

Divergent market performance of PSU and Private Banks

With three years of relative underperformance, private banks now trade at 18% discount to their 10-year average multiples on a forward P/B basis. The valuation gap between private and PSU banks has now narrowed significantly.

Key Takeaway: Reasonable valuations of private banks, pick in credit growth and stable asset quality could provide a good opportunity to invest in private banks. Keeping this in mind, investors could consider investing in HDFC Banking and Financial Services Fund, that aims to invest in equity and equity related instruments of banking and financial services companies. The Fund has ~60% exposure to private banks, making it a strong thematic play on the growth and performance of the private banking sector. This Fund endeavours to follow a multi-cap approach and invest in companies, which are (a) Leaders and/or are gaining market shares due to better execution, scale, better adoption of technology etc., (b) Likely to witness steady and secular growth, and (c) Likely to see a turnaround in profitability and have potential of being re-rated.

Sources: RBI, Bloomberg, Kotak Institutional equities and other publicly available information

About Tuesday’s Talking Point (TTP): TTP is an effort by HDFC AMC to guide key conversations in the Indian financial markets and investing ecosystem. We aspire to do this by providing relevant facts, along with our perspective on the issue at hand. Please provide your feedback at this link: https://forms.office.com/r/Cr8JNjMGWk

Disclaimer: Views expressed herein are based on information available in publicly accessible media, involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied herein. The information herein is for general purposes only. Stocks/Sectors/Views referred are illustrative and should not be construed as an investment advice or a research report or a recommendation by HDFC Mutual Fund (“the Fund”) / HDFC Asset Management Company Limited (HDFC AMC) to buy or sell the stock or any other security. HDFC AMC is not indicating or guaranteeing returns on any investments. Past performance may or may not be sustained in the future and is not a guarantee of any future returns. The recipient(s), before taking any decision, should make their own investigation and seek appropriate professional advice.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

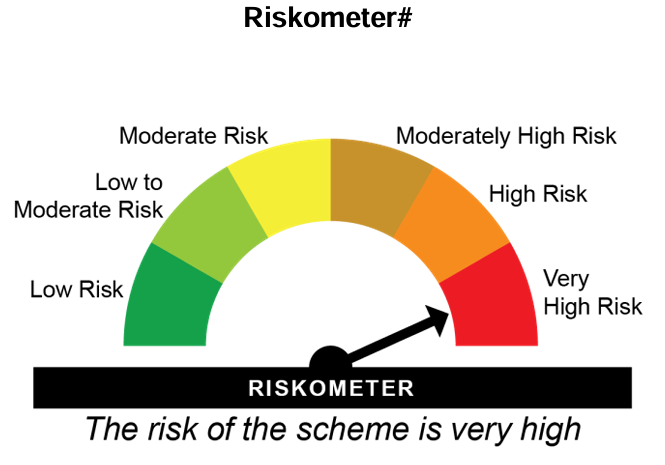

Product Labelling and Riskometer of HDFC Banking and Financial Services Fund

|

HDFC Banking and Financial Services Fund (An open ended equity scheme investing in banking and financial services sector) is suitable for investors who are seeking*: |

|

|

|

|

*Investors should consult their financial advisers, if in doubt about whether the product is suitable for them. #For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund viz. www.hdfcfund.com. |

The Scheme being sectoral in nature carries higher risks versus diversified equity mutual funds on account of concentration and sector specific risks.

Did you find this interesting?

Your opinion matters - share your thoughts and help us improve.