Last Updated On: 28 Nov 2025

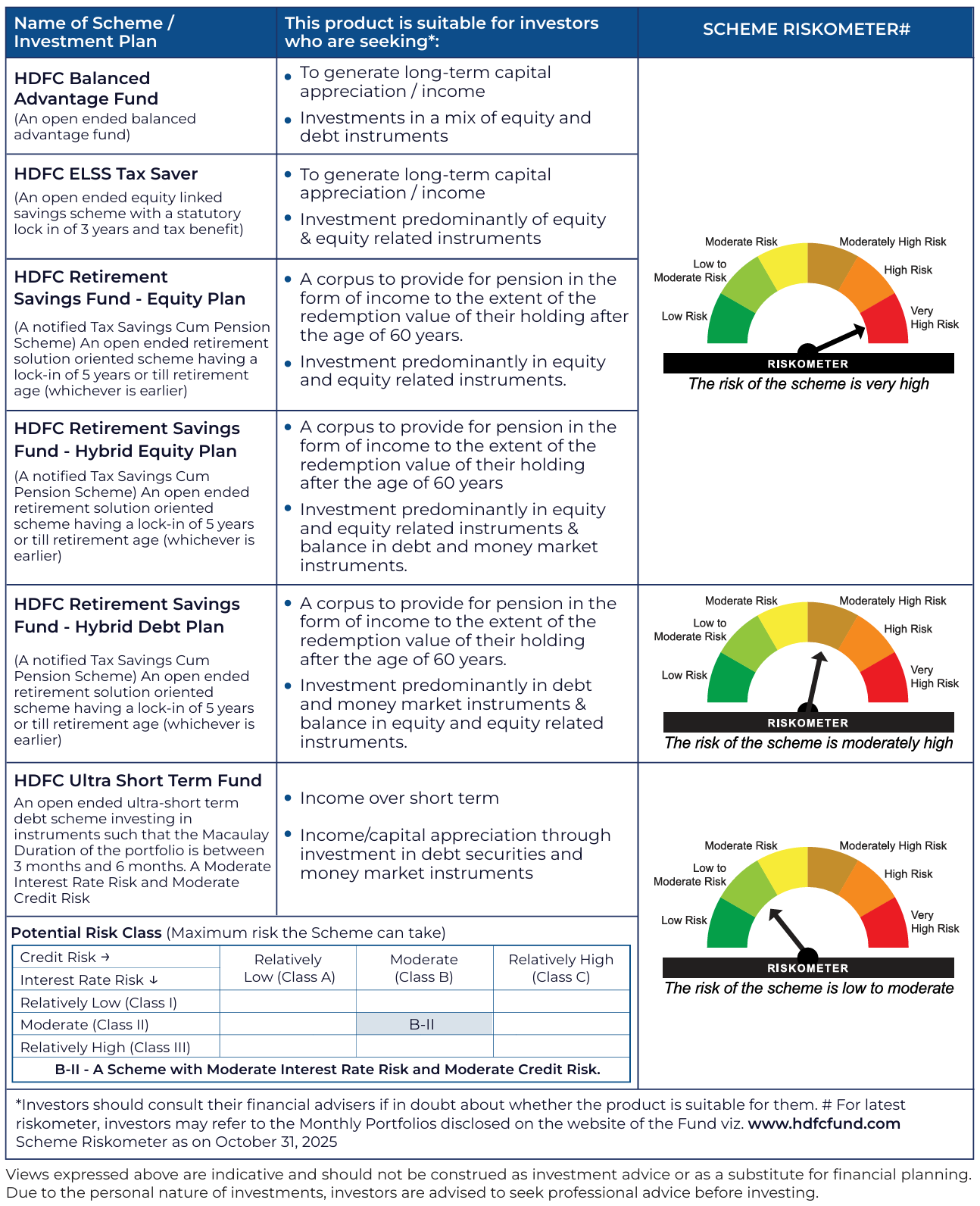

Different goals require investments in different Mutual Fund Schemes. Investors may consider the following schemes as per their goals:

For long-term wealth creation: HDFC Flexi Cap Fund and HDFC Balanced Advantage Fund

For tax saving: HDFC ELSS Tax Saver

For retirement: HDFC Retirement Savings Fund

For an emergency corpus: HDFC Ultra Short Term Fund

A. HDFC Flexi Cap Fund - SIP Performance - Regular Plan - Growth Option

| Since Inception* | 15 year SIP | 10 year SIP | 5 year SIP | 3 year SIP | 1 year SIP | |

| Total Amount Invested (₹ in lacs) | 37.00 | 18.00 | 12.00 | 6.00 | 3.60 | 1.20 |

| Market Value as on October 31, 2025 (₹ in lacs) | 2,269.24 | 73.16 | 32.81 | 10.48 | 4.89 | 1.31 |

| Returns (%) | 21.01 | 16.96 | 19.10 | 22.47 | 20.99 | 16.99 |

| Benchmark Returns (%)# | 15.11 | 14.85 | 15.86 | 15.95 | 15.48 | 13.97 |

| Additional Benchmark Returns (%)## | 13.87 | 13.68 | 14.62 | 13.89 | 13.55 | 14.42 |

@Assuming ₹10,000 invested systematically on the first Business Day of every month over a period of time. CAGR returns are computed after accounting for the cash flow by using XIRR method (investment internal rate of return) for Regular Plan - Growth Option. The above investment simulation is for illustrative purposes only and should not be construed as a promise on minimum returns and safeguard of capital. SIP - Systematic Investment Plan.

B. HDFC Flexi Cap Fund - Performance - Regular Plan - Growth Option

NAV as on October 31, 2025. ₹2,068.833 (per unit)

| Period | Scheme Returns (%)$ | Benchmark Returns (%)# | Additional Benchmark Returns (%)## | Value of investment of (₹) 10,000 | ||

| Scheme (₹)$ | Benchmark (₹)# | Additional Benchmark (₹)## | ||||

| Last 1 Year | 10.20 | 5.56 | 7.59 | 11,020 | 10,556 | 10,759 |

| Last 3 Years | 22.10 | 16.49 | 13.90 | 18,212 | 15,812 | 14,781 |

| Last 5 Years | 29.36 | 21.08 | 18.56 | 36,269 | 26,046 | 23,449 |

| Last 10 Years | 16.44 | 14.64 | 13.67 | 45,893 | 39,248 | 36,060 |

| Since Inception* | 18.87 | 12.50 | 11.77 | 2,068,833 | 378,225 | 309,445 |

Common notes for the above table A & B: Past performance may or may not be sustained in future and is not a guarantee of any future returns.*Since Inception date:- January 1, 1995. #NIFTY 500 Index (TRI) ##Nifty 50 Index (TRI). The scheme is managed by Ms. Roshi Jain since July 29, 2022. Returns greater than 1 year period are compounded annualized (CAGR). As NIFTY 50 TRI data is not available since inception of the scheme, additional benchmark performance is calculated using composite CAGR of NIFTY 50 PRI values from January 1, 1995 to June 29, 1999 and TRI values since June 30, 1999. Different plans viz. Regular Plan and Direct Plan have a different expense structure. The expenses of the Direct Plan under the Scheme will be lower to the extent of the distribution expenses / commission charged in the Regular Plan. Load is not taken into consideration for computation of performance. Returns as on October 31, 2025.

For performance of other funds managed by fund manager, Please click here.

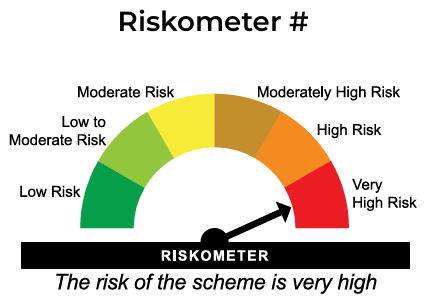

| HDFC Flexi Cap Fund (An open ended dynamic equity scheme investing across large cap, mid cap & small cap stocks.) is suitable for investors who are seeking*: |  |  |

| ||

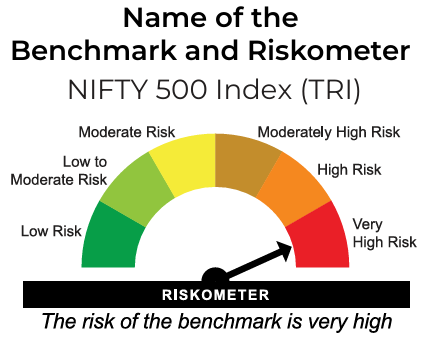

| *Investors should consult their financial advisers, if in doubt about whether the product is suitable for them. #For latest Riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund viz. www.hdfcfund.com Scheme and Benchmark Riskometer as on October 31, 2025. Riskometer # Name of the Benchmark and Riskometer NIFTY 500 Index (TRI) | ||

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

Did you find this interesting?

Your opinion matters - share your thoughts and help us improve.