Tuesday's Talking Points

Time to Turn Optimistic after Equity Underperformance?

What’s the Point?

- Recent Underperformance: Indian equities have lagged global peers over the past year, with NIFTY 50 posting negative one-year returns due to trade tensions, a weak rupee and FPI outflows.

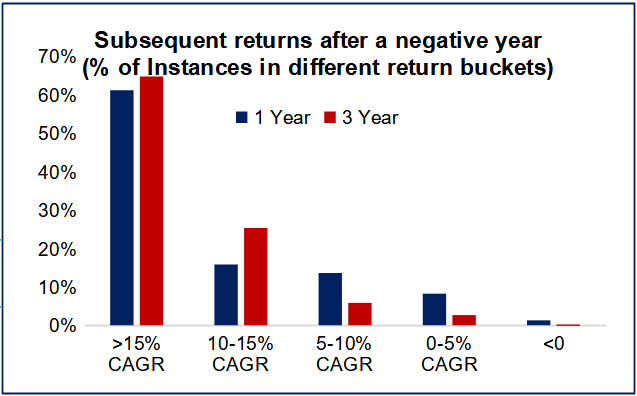

- History of recovery post underperformance: Negative one-year returns are relatively uncommon for NIFTY 50 (18% of total instances in last 2 decades) but historically, they have been followed by strong 1 and 3-year performance.

- Improved Valuations: Moderation in valuations, earnings recovery, consumption push and supportive macro-economic conditions could bode well for long-term investors.

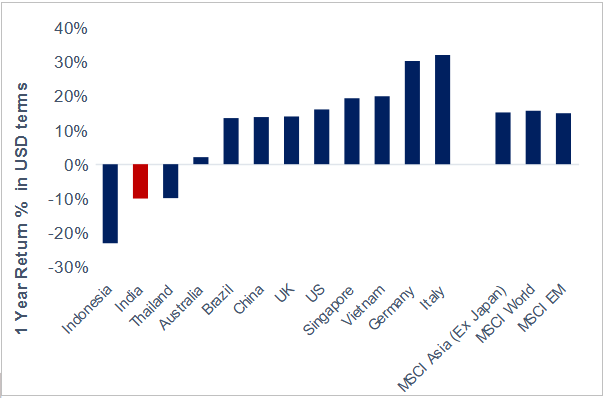

First half of FY26 drew to a close last week and it was certainly an eventful period for Indian capital markets. While trade tensions with US kept volatility in play across the world, for India, the prolonged trade negotiations with US and higher-than-peers tariff on Indian exports meant that this volatility was even more pronounced for Indian markets. Weakening rupee and continued foreign portfolio outflows further weighed on equities. As a result, Indian indices have lagged many global peers recently. In fact, NIFTY 50 posted negative one-year returns for the third consecutive month in September. While this may make investors apprehensive, history suggests that such corrective phases often precede periods of stronger subsequent performance.

Valuation premium narrows as Indian equities lag peers in last 1 year

While Emerging Markets such as China, Brazil etc. and several Developed Markets too have seen stronger performance, India has struggled to keep pace. This relative underperformance is more of an aberration given India’s long-term growth prospects and is largely an outcome of US-India trade uncertainty, weakness in Indian Rupee, foreign capital outflows and relatively elevated valuations.

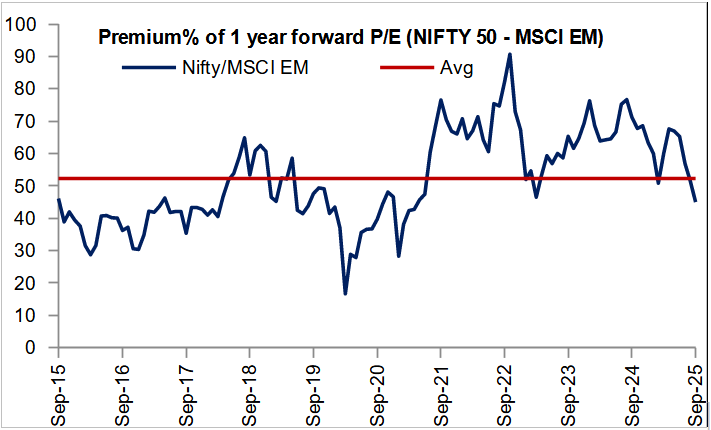

However, the recent underperformance has resulted in moderation of relative valuations for Indian equities vs other Emerging Markets. While India (NIFTY 50) has historically commanded a premium to Emerging Markets (MSCI EM) owing to depth (number of sizeable companies) and width (wide array of businesses) of its equity market, the premium has come down recently and is now below the 10-Year average.

| ^NIFTY 50 has lagged most peers in last 1 Year | Indian Equities: Moderation of premium vs Emerging Markets (EM) after recent underperformance |

|---|---|

|  |

Negative 1 Year returns have historically preceded strong performance

Valuation landscape has improved in the last 1 year

With the recent correction, valuations in Large Caps have moderated relative to their 10-Year Average. Mid-Caps too have seen moderation of valuation premium on account of correction and improved profitability. While the Small Cap Index is still trading at a significant valuation premium similar to that last year, the large number of stocks in the Small Cap universe continue to present opportunities owing to significant valuation divergence.

| Period | NIFTY 100 | NIFTY Mid Cap 100 | BSE Small Cap 250 | |||

| 1 Year Forward P/E | Premium to Prevailing 10-Year Average | 1 Year Forward P/E | Premium to Prevailing 10-Year Average | 1 Year Forward P/E | Premium to Prevailing 10-Year Average | |

| Sep’24 | 22.2 | 17% | 33.4 | 56% | 24.6 | 47% |

| Sep’25 | 20.2 | 6% | 26.4 | 19% | 25.5 | 47% |

Conclusion

For investors, India’s recent underperformance should be viewed in the right perspective. A period of relative underperformance is expected after a few years of robust returns. Further, negative one-year returns have historically been followed by robust equity performance. With moderation in large-cap valuations, supportive consumption trends, recovery in corporate earnings, healthy monsoon and benign inflation; Indian equities could continue to remain well positioned for long-term wealth creation.

^As of 30th September 2025, Sources: Bloomberg, MFI Explorer and other publicly available information

About Tuesday’s Talking Point (TTP): TTP is an effort by HDFC AMC to guide key conversations in the Indian financial markets and investing ecosystem. We aspire to do this by providing relevant facts, along with our perspective on the issue at hand. Please provide your feedback at this link: https://forms.office.com/r/Cr8JNjMGWk

Disclaimer: Views expressed herein are based on information available in publicly accessible media, involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied herein. The information herein is for general purposes only. Stocks/Sectors/Views referred are illustrative and should not be construed as an investment advice or a research report or a recommendation by HDFC Mutual Fund (“the Fund”) / HDFC Asset Management Company Limited (HDFC AMC) to buy or sell the stock or any other security. The Fund/ HDFC AMC is not indicating or guaranteeing returns on any investments. Past performance may or may not be sustained in the future and is not a guarantee of any future returns. The recipient(s), before taking any decision, should make their own investigation and seek appropriate professional advice.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.